I've written here before about how important it is for each of us, as makers and tech professionals, to stay aware and involved in the development of the "Internet of Things" because it represents a milestone in the development of the World Wide Web. IoT has the potential to change our lives as profoundly as the introduction of personal computers. However, much like the rest of the Internet, IoT could also become a powerful surveillance device for both good and bad governments and organizations. One thing that's going to play heavily into the calculus of IoT's fate is the corporate philosophy of IoT's biggest players. Today we'll explore two companies vying for IoT supremacy: one on the infrastructure level and one on the device level.

Player One: Cisco Systems

“We can solve that problem because we own the network.”

You've definitely heard of Cisco. Their logo might be on your home router; it's definitely on most of the switches between your home router and this web page. Cisco is the largest networking company in the world with over 50 percent market share in the switching/router market alone and nearly $50 billion (with a b!) in revenue in 2016. It's fair to say Cisco provides many of the vertebrae from which the Internet Backbone is built.

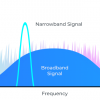

With credentials like that, Cisco seems like a shoe-in for IoT market dominance (and they think so, too). In a keynote presentation at the Cisco Partner Summit in 2016, Rowan Trollope, senior vice president and general manager of the IoT & Applications Group at Cisco, claimed that "the internet as we know it today, and the network that you operate, will not work for the internet of things." A fair point, seeing as IoT could see an unprecedented number of devices joining the web. Trollope, not one to focus on bummers, offered help: "We can solve that problem because we own the network."

Cisco's plan? To certify IoT devices as being compatible with their network-based software and then allow the software to automatically authorize certified end-points. To help put their plan into action, Cisco acquired Jasper Technologies in 2016. The resulting cloud platform, Cisco Jasper, is already connecting everything from Coca-Cola vending machines to GE jet engines.

Should we be wary of Cisco's offer to solve our network management problems? Well, possibly. In 2008, Wired News uncovered a leaked internal presentation that appeared to show Cisco exploring the economic opportunity of China's Golden Shield program (also known as The Great Firewall of China), and while this was only part of a larger presentation, the apparent willingness of such a large company to assist in stifling free expression for economic gain continues to draw the ire of organizations like the EFF. Cisco was later accused of cooperating with NSA mass-surveillance programs in discussions following the Edward Snowden leaks.

Is it fair to characterize Cisco as an enemy to privacy? Possibly not. But when you "own the network," you need to be prepared to stand up to some serious scrutiny.

Player Two: ARM Holdings

Already at the heart of most IoT devices

There is ARM architecture within meters of you, statistically speaking. ARM-licensed processor designs are used in everything from smart watches to supercomputers. Where they really shine is in mobile phones, tablets and laptops where their characteristic low-power consumption helps boost battery life and improve performance. Not only the CPUs but also the GPUs, radios and possibly the charge controllers in these devices contain ARM-licensed cores. It's no surprise that ARM cores end up in the vast majority of IoT devices.

In late 2016, ARM made their intentions in the IoT market known as they introduced the mbed Cloud software-as-a-service platform, which aims to manage and update IoT processors over the lifespan of their deployment. They also developed extremely small and low-cost processor cores that incorporate their TrustZone hardware-based security technology.

Lest you think that ARM is in a weak position compared with Cisco when it comes to network dominance, ARM Holdings has agreed to an offer by SoftBank Group of Japan. If the deal is approved, SoftBank (which also owns the telecom company Sprint) could open doors that were previously sealed to ARM.

It's also possible that the IoT revolution will take place on ARM's home field: the end-point hardware. In late 2015, the OpenFog Consortium was founded to promote interest in and development of fog computing. Fog computing is an architecture that aims to keep the majority of storage, communication and control off of primary gateways and, indeed, the Internet Backbone --- the theory being that end-point and edge devices (the kind that usually run ARM cores) could collaborate in a kind of massive mesh network. Interestingly, both ARM and Cisco are founding members of the consortium.

Darkhorse: Microsoft

All Aboard the Partner-ship

There is one more company worth mentioning whenever IoT is on the table, and that company is Microsoft. Over the years, Microsoft has gotten very good at forming strategic business relationships in order to assess (and later to target) markets that are outside its core focus. In fact, Microsoft has been pretty aggressive in their courting of the IoT market, and their involvement includes most of the initiatives I've already talked about in this blog post.

For instance, Microsoft was alongside Cisco and ARM in founding the OpenFog Consortium. They also partnered with Cisco in 2015 to launch the long-winded Cisco Cloud Architecture for the Microsoft Cloud Platform, which leveraged Microsoft's Azure cloud platform and Cisco's infrastructure to deliver a fully integrated cloud solution. Microsoft must have liked some of Cisco's IoT ideas because just this year they poached Cisco's IoT Leader, Tony Shakib, and made him general manager of their IoT Intelligent Cloud business.

How else is Microsoft ensuring a future for their Azure cloud platform? One good way is by working with Qualcomm to bring full-scale Windows 10 to ARM devices. For years, ARM's dominance in the embedded device market hurt Microsoft because their aging Windows Embedded operating system couldn't compete with others that were designed to be fully capable on ARM architecture. Microsoft was, in effect, being edged out by other companies that played nice with ARM. With Windows 10 coming to ARM-based devices, Microsoft stands a chance at getting a lot more IoT devices onto their Azure platform.

The Winner?

We're still in the early days of IoT, so it's hard to imagine who might come out on top. That being said, it may be important to decide who we want to be on top (or if we want anyone on top, at all) before the dust settles. Remember, as a hobbyist and as a developer, the platforms that you choose for hosting your projects will ultimately gain traction in the market. Learn a little bit about the companies that are going to steer our digital fate and vote with your data. The future of the Internet is in your hands!

Nick, I agree that these are three very important players in IoT but I think it is important to start with a model of IoT and then see which players fall out at each stage. The most commonly used model consists of three parts.

1) Sensors, actuators and edge devices. These may be finished consumer products or things that are used to build or add on to existing systems. Typically these are low on compute resources, but they are the "things" we see. 2) Hubs, these may be dedicated or not, in non consumer environments they may be an upgraded PLC or a device that plus into a PLC, in automotive they may be the ICE or wireless gateway. This is where the "FOG" exists. Local compute, filtering and aggregation. In some architectures these physical hubs may be omitted but likely exist in software on the backend. Increasingly though we are going to see devices (like network switches and routers) that are capable of handling this without the need for additional hardware. In fact Cisco and others have been doing this for applications such as smart meters for some time. 3) Cloud based backend. A compute and storage rich environment where applications that can leverage the hubs and endpoints to create new applications. Currently lots of this is big data analytics (more sensors than actuators) but we can expect the types of application to change.

Given this model you have to include players like Amazon who have investments in all three. ARM and its licensees will dominate in (1) and they are in a fight for (2) but (2) requires software and there are a lot of people trying to play in this space. Potentially it is somewhere Microsoft could do very well, but so can companies with a focus on middleware, security or comms. All of the major cloud IaaS platforms will and already are doing very well from IoT and there is some evidence that each may attract a slightly different type of application based on the other services they provide (GCP makes a great IoT analytics platform)

You can find various diagrams that do this mapping if you search on line but if you just want to stick with the big players then I think you should be adding AWS, Google and Intel.

I know these are the "top competitors" in the market, but there's a lot of companies out there vying to have a stake in IoT.

Besides the above, you got Nokia, Ericsson, Google, Facebook, Qualcomm, etc. The problem is, every company is trying to be the "go-to" for something specific in IoT. Some want to be the complete solution, others want their products used a consumer product.

My hope is that no single company will dominate the IoT. BTW the company I work for has been doing IoT for at least 10 years. Remote telemetry has been leveraging the internet for communication long before IoT was an idea. There is nothing really new about it. It just means that a device (not necessarily a PC or Mac) can send or receive data over the internet or intranet.

I agree with you on all points. As for IoT being a rehash of old ideas, I wrote a little bit about that in my blog post titled "The Internet of Things is a Scam!"

In my head, I refer to IoT Devices as NBEDs, or Non-Browser Endpoint Devices, because I think that concisely defines what we mean by "IoT"